General News

Taxman Banks On Mobile Verification In Fake Stamps War

The Kenya Revenue Authority (KRA) has urged consumers to verify the validity of excise duty stamps on products using smartphones, as the taxman seeks to discourage the use of fakes that deny it billions of shillings in revenue.

The taxman has launched a new mobile phone app dubbed Soma Label that will scan and verify the new generation excise stamps it unveiled recently, targeting counterfeit products such as wines, spirits and tobacco products.

The upgraded excise stamps have a quick response code (QR code) for distributors, retailers and consumers using the app to verify the authenticity of the products.

The new stamps are part of the KRA’s wider scheme to ride on electronic goods management system (EGMS) to combat illicit trade, seal revenue leakages and boost collection.

“The rollout will be implemented in three phases with the first one targeting wines, spirits, ready-to-drink beverages, beer and other tobacco products,” said KRA in a statement yesterday. “Water, soft drinks and juices will have the new stamps from 28th December 2021, whereas tobacco products and keg beer will be covered from February 1, 2022.”

The new excise stamps replace the current batch introduced about five years ago.

The taxman, however, said that the old generation paper stamps affixed on wines, cigarettes, beers and spirits will continue to be in use for one month after the dates of the rollout.

In the last financial year, the KRA collected Sh216.3 billion in excise taxes and is targeting Sh259.6 billion in the current fiscal year. Over the last five years, the taxman estimates it has lost about Sh70.3 billion from excise tax evasion.

Alcohol and cigarettes are the largest contributors to the excise duty receipts, accounting for more than three-quarters of the collections.

The KRA, for example, now charges an excise duty of Sh278.80 per litre of spirit, Sh208.20 for a litre of wine, and Sh121.85 for beer, while smokers pay Sh3.48 per stick of cigarette with a filter.

General News

IMF Criticizes Kenya’s Fuel Subsidy Re-Introduction, Warns of Budget Distortion

The International Monetary Fund (IMF) has criticized Kenya for re-implementing the fuel subsidy scheme, expressing concerns that the lack of funds to pay oil marketers could distort the budget.

Despite a previous commitment by President William Ruto in 2022 not to subsidize pump prices, the government reintroduced the subsidy, preventing petrol and diesel prices from reaching higher levels in October 2023.

The IMF argues that the subsidy was applied without available funds, as the Treasury has yet to pay oil marketers at least Ksh9 billion ($55.6 million) accumulated from the previous year. President Ruto’s decision to reinstate subsidies goes against conditions set by the IMF for accessing loans.

Petrol and diesel prices, which were Ksh217.36 ($1.34) and Ksh205.47 ($1.27) respectively in Nairobi in October 2023, remained lower than the potential Ksh220.43 ($1.36) and Ksh217.11 ($1.34) due to the subsidy. However, the IMF disapproves of the decision, emphasizing that the removal of the subsidy was a key condition for a 38-month budget support scheme.

The IMF criticizes the prolonged process of forming a taskforce and delays in implementing decisions regarding fuel pricing.

The removal of the subsidy in May of the previous year led to record-high pump prices, crossing the Ksh200-mark later in the year due to a combination of subsidy removal and a VAT increase to 16 percent.

Kenya’s administration, faced with rising fuel costs, chose to reinstate the subsidy, prompting the IMF to raise alarms over the lack of budgeted funds and potential distortions in the country’s financial plans.

The ongoing disagreement highlights the challenges and consequences associated with balancing domestic economic policies and meeting international financial commitments

General News

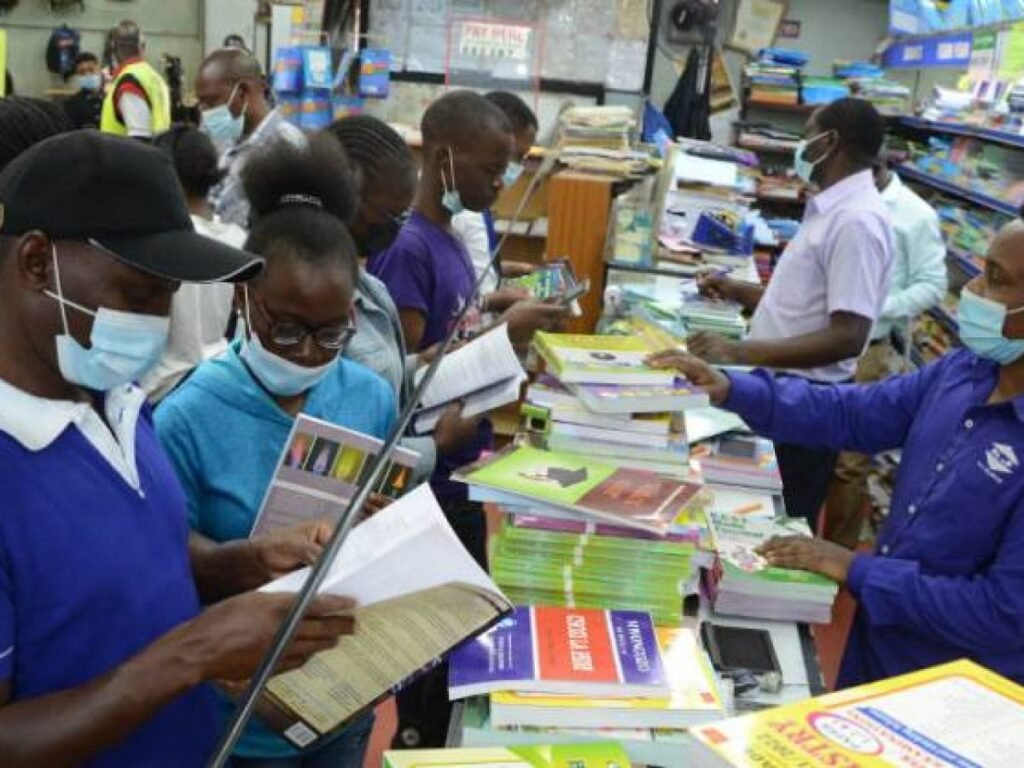

Parents in Meru County Turn to Second-Hand Books Amid Economic Hardships

As the back-to-school rush season unfolds in Meru County, a growing number of parents are making a strategic choice to purchase second-hand books for their children.

This decision stems from the challenging economic conditions that have prompted families to seek ways to cut costs.

Among these parents is Ms. Prisca Gakii, who revealed that opting for second-hand books allows her to save money, which can then be allocated towards essential expenses like school fees.

She highlighted a practical advantage for Form-One students, emphasizing that using older books can protect them from potential theft, as new books often become targets for less scrupulous classmates.

Ms. Gakii pointed out a notable price difference, citing an example of a new Oxford dictionary priced at almost Sh1,900, compared to a used one available for Sh1400.

She justified her preference for the older but more affordable option, emphasizing that they contain the same content.

Janet Wamuyu, a second-hand books trader, shed light on the lucrative nature of their business during the opening of the first term, which coincides with the peak season.

As learners transition to new grades or classes, there is a heightened demand for various books, including dictionaries, Kamusi, and Golden Bells.

Wamuyu explained that this period, especially when Form-One students are joining school, facilitates easy acquisition of books for new stock.

The trading process involves exchanging books for the next grade or class at a lower rate, providing an economical alternative for parents instead of purchasing an entirely new set of books.

She further noted that their source of new stock comes from parents whose children have completed their studies and no longer require the books.

Despite the success during the peak season, Wamuyu acknowledged the challenges faced during other times of the year when only a few revision books are in demand, highlighting the cyclical nature of the business in Meru County.